how much does nc tax your paycheck

North Carolina Income Tax Rate. There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted.

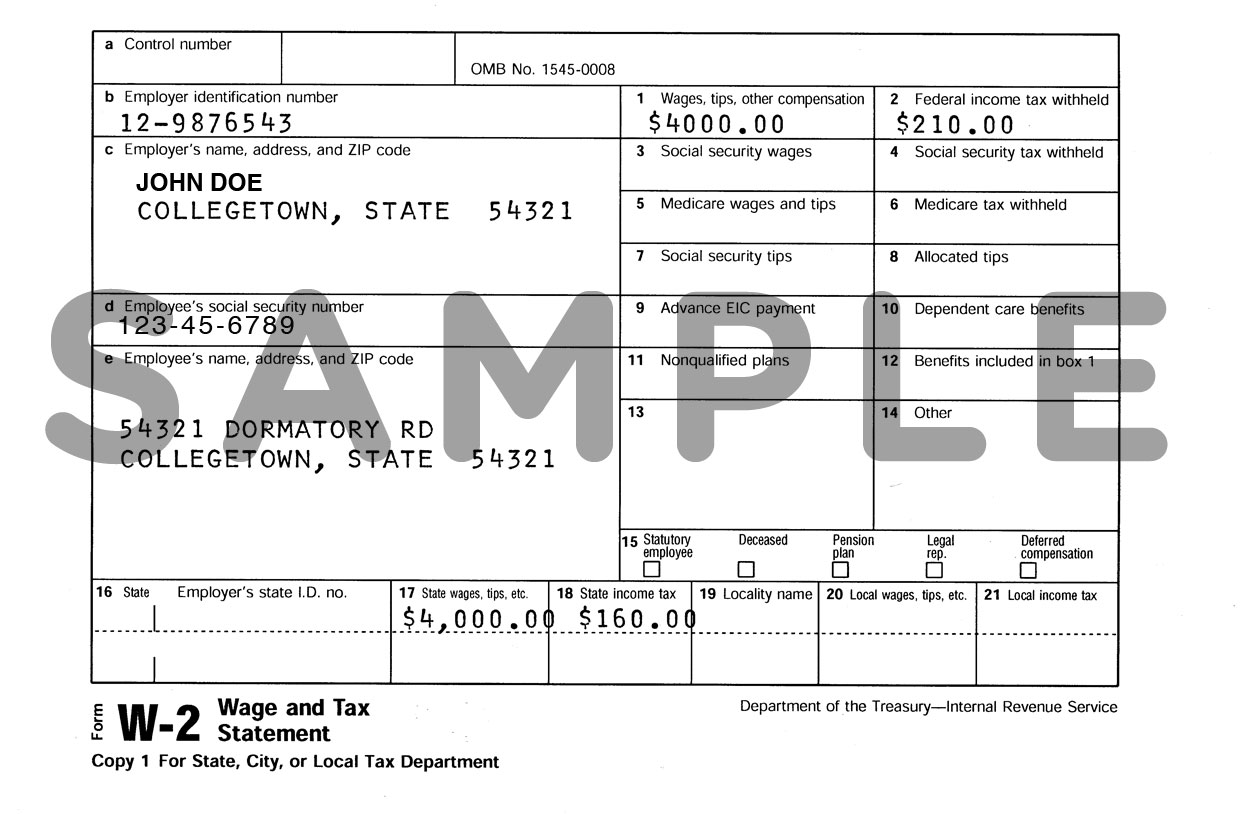

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

North Carolina Sales Tax.

. Round off the withholding to the nearest dollar amount for example if the withholding was 2549 then enter 2500 if it is 2550 then enter 2600. Including any income from sources outside North Carolina. Do not mark through the pre-printed zeros.

Mailing Address 1410 Mail Service Center Raleigh NC 27699-1410. Switch to North Carolina salary calculator. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

North Carolina payroll taxes are as easy as a walk along the outer banks. No state-level payroll tax. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on. Both employers and employees are responsible for payroll taxes.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. North Carolina income tax rate. Census Bureau Number of cities that have local income taxes.

North carolina salary paycheck calculator. Tax Write-Offs You Dont Know About. A you are married filing a separate return and you lived with your spouse at any time in 2021 or b one-half of.

Income Tax Brackets for Other States. Our paycheck calculator is a free on-line service and is available to everyone. North Carolina Paycheck Quick Facts.

North Carolina state tax on sales and use starts with a base rate of 475 percent with each county adding a local rate of between 2 and 275 percent. However withdrawals from retirement accounts are fully taxed. This article is part of a larger series on How to Do Payroll.

The Calculator will help you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. North Carolinas income. Important Information for Annual Experience Rating for 2022 Tax Rates.

Plus to make things even breezier there are no local income taxes. However the 62 that you pay only applies to income up to the social security tax cap which for 2021 is 142800 up from 137700 in 2020. The following individuals are required to file a 2021 North Carolina individual income tax return.

This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. That rate applies to taxable income which is income minus all qualifying deductions and exemptions as well as any contributions to a retirement plan like a 401k or an IRA. The individual income tax rate in North Carolina is 525 percent for tax years 2019 2020 and 2021 with a maximum rate of 625 percent 00525.

To use the calculator. North Carolina moved to a flat income tax beginning with tax year 2014. OSC Training Center 3514 Bush Street Raleigh NC 27609.

Do not include any social security benefits in gross income unless. However 2019 brought an. No personal information is collected.

For tax year 2021 all taxpayers pay a flat rate of 525. The individual income tax rate in North Carolina is 5499 percent for tax years 2017 and 2018 and it will be 5499 percent in 2019. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This North Carolina hourly paycheck calculator is perfect for those who are paid on an hourly basis. Income Tax Deductions for North Carolina. North Carolina has an individual income tax rate of 525 that applies to all income levels.

Be aware that North Carolina requires you to complete this form even if you have no employees for a quarter. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Online Filing for Withholding.

To pay this tax each quarter you will complete the Employers Quarterly Tax and Wage Report to report wage and tax information. 10 rows You are able to use our North Carolina State Tax Calculator to calculate your total tax. Additionally pension incomes are fully taxed.

The North Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and North Carolina State Income Tax Rates and Thresholds in 2022. However write the check for the correct amount withheld example. Raleigh NC 27609 Map It.

Rates can be as low as 006 or as high as 576. The income tax is a flat rate of 525. To calculate your taxable income multiply your NC taxable income by the tax rate of 525.

Published January 21 2022. All told the average North Carolinian is paying 2212 a year in income taxes. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Taxable Wage Base for 2022. Details of the personal income tax rates used in the 2022 North Carolina State Calculator are published. North Carolina tax year starts from July 01 the year before to June 30 the current year.

Compare State Tax Brackets Rates For your personal Effective IRS Tax Rate use the RATEucator Tool. When it does come to the tax side of things if youre considering a move to North Carolina for retirement its important to keep the following in mind. Social Security income in North Carolina is not taxed.

Luckily when you file your taxes there is a deduction that allows you to deduct the half of the fica taxes that your employer would typically pay.

Paycheck Calculator Take Home Pay Calculator

I Make 800 A Week How Much Will That Be After Taxes Quora

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Pay Stub Requirements By State Overview Chart Infographic

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

Salary Paycheck Calculator Calculate Net Income Adp

I Make 800 A Week How Much Will That Be After Taxes Quora

New Tax Law Take Home Pay Calculator For 75 000 Salary

How To Take Taxes Out Of Your Employees Paychecks With Pictures

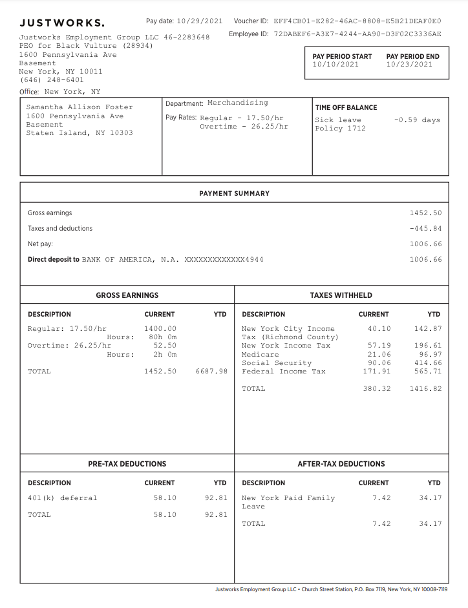

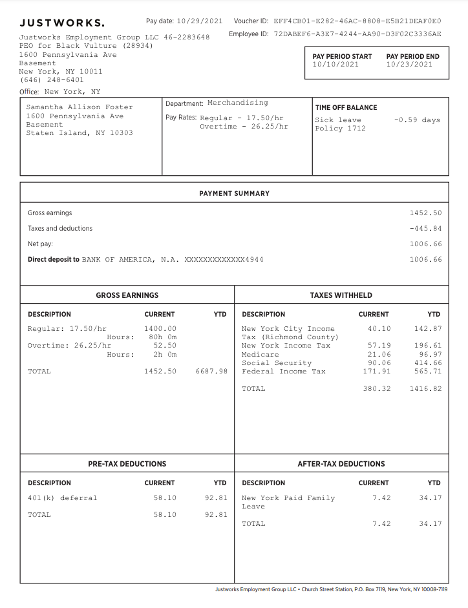

Questions About My Paycheck Justworks Help Center

Free Online Paycheck Calculator Calculate Take Home Pay 2022

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

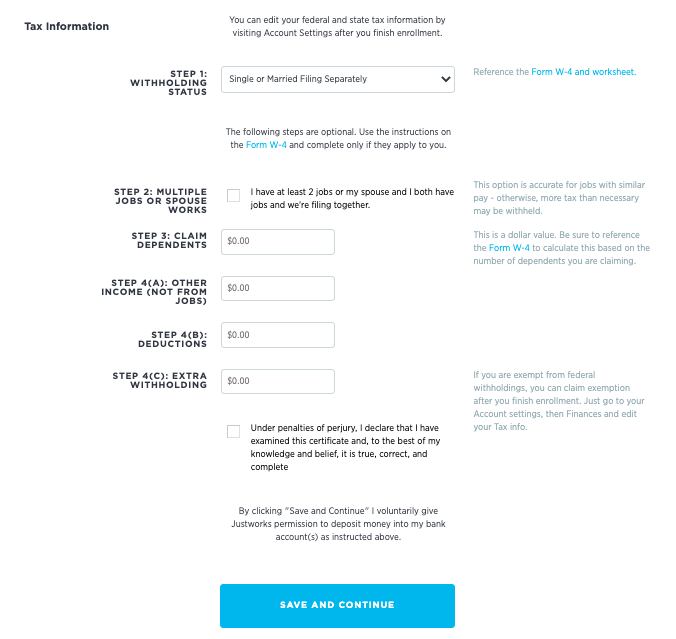

Tax Information Career Training Usa Interexchange

Questions About My Paycheck Justworks Help Center

Tax Information Career Training Usa Interexchange

Here S The Average Irs Tax Refund Amount By State

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math